A New Engel on the Gains from Trade: Theory and Evidence Within and Across Countries

Topics

Development

Initiatives

International Trade & Development

Development

International Trade & Development

by Barry Eichengreen, William Jungerman and Mingyang Liu

Although multiple studies have attempted to estimate the impact of Brexit on FDI flows into and out of the UK, no previous study appears to have undertaken a similar analysis of portfolio capital flows and financial intermediation services. This project will take three approaches to addressing these questions. The first approach will use data from the IMF’s Consolidated Portfolio Investment Survey to estimate the impact of EU membership on capital flows. Using these data, it will be possible to estimate a gravity-theoretic model of total gross portfolio capital inflows and total gross portfolio capital outflows for each country pair, pooling cross-sections for different years and attempting to identify an EU membership effect. A second approach will then replicate this analysis using bank-intermediated flows using the Bank for International Settlements’ Locational Banking Statistics. The third approach will then analyze the determinants of international financial center status and ask how this is affected by the same variables (notably by EU membership, customs union membership, and participation in the euro area). The financial consultancy Z/Yen Group provides annually a list of top international financial centers based on an extensive online questionnaire. Its Global Financial Centres Index (GFCI) is an ordinal ranking of financial centers around the world (averaging some 70 in number). Rank-ordered logit models will be used to analyze the determinants of financial center status, where the key explanatory variables will be financial links (assets and liabilities of the country in which the financial center is located, again from the CPIS) and trade data (from the IMF’s balance of payments statistics), where the effects of these variables will allowed to vary with EU membership. These estimates will then be used to construct counterfactuals for various Brexit scenarios to answer the question of how London’s financial center status will be affected.

For a paper draft, see this.

Capital flows

Financial Globalization

by Ross Levine

This research will evaluate the impact of the 1400-1900 African slave trade on household and firm financing constraints today. The study of the historical determinants of finance is important both for understanding the evolution of the institutions that shape the operation of financial systems and for providing guidance to current policy analysts and policymakers about key barriers to the development of more efficient financial markets and institutions. The project will exploit cross-country and cross-ethnic group differences in the intensity with which people were enslaved and exported from Africa during the 1400-1900 period to identify the impact of the historic slave trade on modern financial systems. This work will provide evidence on whether the slave trade—which has had an enduring, deleterious effect on social cohesion—continues to harm the operation of credit institutions.

Capital flows

Financial Globalization

by Dmitry Livdan, Vladimir Sokolov and Amir Yadon

For a draft of the paper, see here.

Using a novel data set for Russian exporters allowing for the exact firm-to-firm distances, this project investigates the micro-foundations of gravity by testing at all levels of trade flows: individual cargo, firm, and country. We find that distance does a poor job explaining variation in individual cargo values as most of its explanatory power is absorbed by the recipient fixed effects and transportation dummies. At the firm level the export value increases/decreases with distance with/without the recipient fixed effects in the gravity specification. In addition, the classic gravity holds at the country level in spite of Chaney (2016) gravity sufficiency conditions being violated for Russian exporters. To rationalize these findings, we propose that for gravity to hold at the country level, the firm-level level extensive trade margin — the number of shipments — has to decline faster than the intensive trade margin — value-per-shipment — increases with distance. We develop a network based model of firm-to-firm trade to support our empirical evidence.

Development

International Trade & Development

by Gabriel Zucman (UC Berkeley) and Anders Jensen (Harvard Kennedy School)

For a presentation of this research, see here.

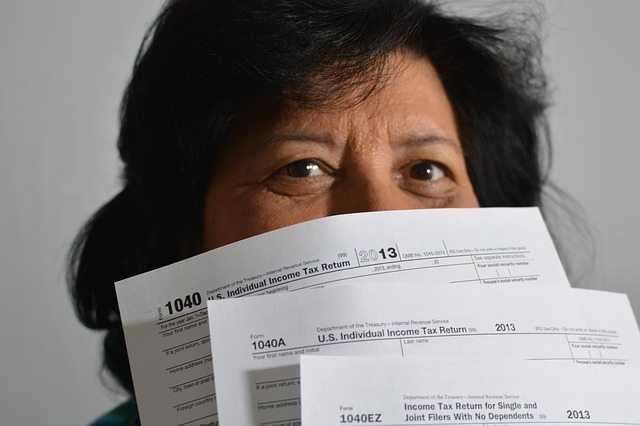

Why do developing countries have low tax-to-GDP ratios? Is it because they are not able to tax (due, e.g., to the informal structure of the economy) or because they are not trying to tax (due, e.g., to political economy reasons leading to low tax rates on high-income earners)? To address this question, this project aims at estimating tax progressivity in a large set of countries across levels of development, by combining national account data, tax statistics, and legislative information. This will allow us to analyze whether tax progressivity can account for differences in tax-to-GDP ratios across development levels today. As a useful benchmarking exercise, we will equalize tax progressivity across developing countries, assuming no behavioral responses, in order to estimate the share of the tax revenue gap that can be explained by lower taxes on top-earners.

Development

International Trade & Development