by Yuriy Gorodnichenko

For a draft of the paper, see here.

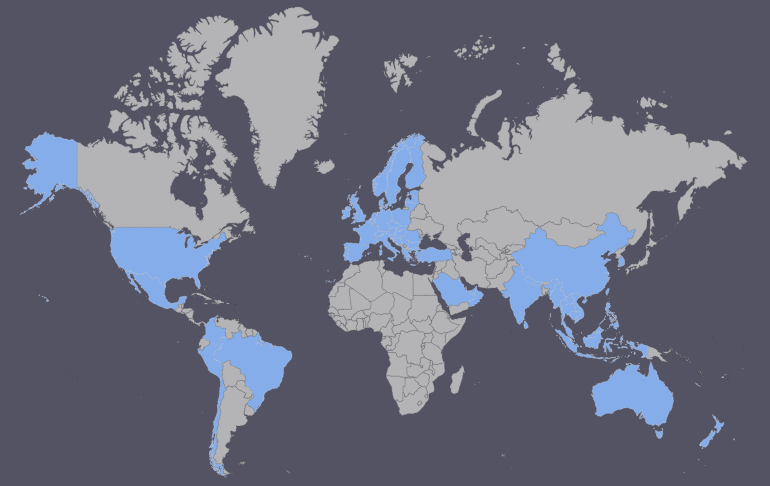

The objective of this project was to study (mis)allocation of resources using a new survey from the European Investment Bank (EIB) and existing surveys run by the European Bank of Reconstruction and Development (EBRD). The main appeal of these surveys was information about various margins of adjustment as well as questionnaires consistent across a broad range of countries. The survey run the EBRD turned out to be less useful than originally anticipated: while the questionnaires are consistent across countries in a given wave of the survey, there were changes in the questionnaires across waves which limits the usefulness of the surveys for time series analyses. As a result, most of the work focused on the EIB survey.

Using the EIB data, we show that the dispersion in the use of resources among EU firms is large: about 50 percent wider than what has been found by previous studies for the US. We develop a simple dynamic theoretical framework of profit maximizing firms and estimate the dispersion of the marginal revenue product of capital (MRPK) and the marginal revenue product of labor (MRPL) in the EU and individual countries. Our calculations suggest that reducing the EU dispersion in marginal revenue products to US levels – a change that would likely require many significant policy reforms – could increase the EU’s GDP by more than 20 percent.

We also use of Machado-Mata decomposition to construct counterfactual distributions of marginal revenue products for each country (Machado and Mata, 2005). This decomposition exercise helps us to understand better whether the observed variation in marginal revenue products is brought about by either (i) cross-country differences in firm characteristics or (ii) cross-country differences in how the business, institutional and policy environment guides the allocation of resources across heterogeneous firms, i.e. how regression coefficients on characteristics are “priced” into outcomes.

We find that cross-country variation in the dispersion of marginal revenue products is largely driven by differences in a country’s business, institutional and policy environment rather than by differences in firm characteristics per se. This result is important because it provides large-scale microeconomic evidence that institutions matter to explain the variation in marginal revenue products across EU firms. Using the example of Greece and Germany, we show that the dispersion of marginal revenue products is wider among firms in Greece than in Germany. However, the results suggest that if German firms were moved to Greece, they would not be more efficient than Greek firms: the dispersion of marginal revenue products for German firms would be even wider than the one actually observed in Greece. The Greek business, policy and institutional environment seems to be relatively ineffective in reducing the dispersion of marginal returns across firms. If Greek firms were to be moved to Germany instead, they would be almost as efficient than German firms: the standard deviation of this counterfactual distribution is much closer to the actual distribution of marginal revenue products in Germany. In other words, the German business, institutional and policy environment appears to help improve the equalization of returns across heterogeneous firms.