by Sergii Meleshchuk

For a draft of the paper, see here.

Most models in contemporary international economics and macroeconomic literature make the assumption that sellers charge all buyers the same price for the same good in a specific geographic market. In reality, however, a lot of business-to-business transactions occur in decentralized markets. Sellers of intermediate inputs have the power to vary prices across their buyers even if marginal costs of production are the same. In other words, sellers price-discriminate buyers. Anecdotally, quantity discounts (or second-degree price discrimination) are a common form of price discrimination in business-to-business transactions. However, welfare consequences of quantity discounts in general equilibrium models, as well as optimal policies in this setting remain largely understudied.

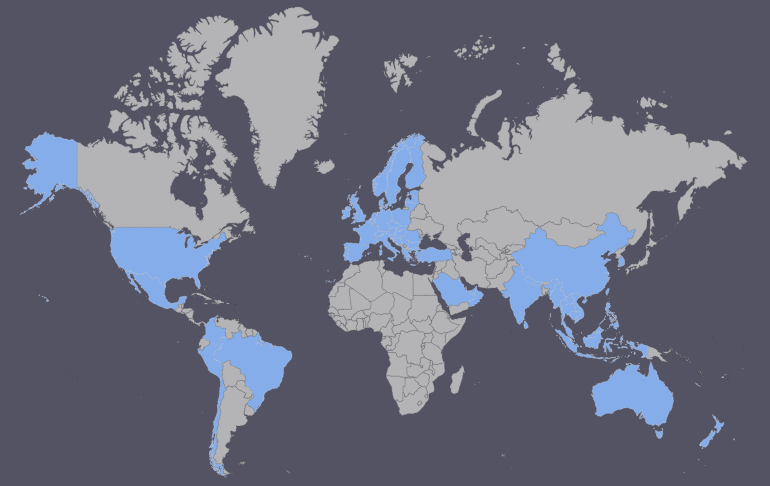

In an attempt to shed light on this matter, I make three contributions. First, I provide evidence of price discrimination in the transaction-level Colombian imports data. Second, I develop a tractable theoretical framework that embeds second-degree price discrimination into a widely-used class of gravity models in international trade and characterize optimal policies. Third, I calibrate the model using Colombian transaction-level data and use the calibrated model for welfare calculations.

My analysis proceeds in three steps. In the first step, I use Colombian transaction-level microdata to document a new set of stylized facts about price discrimination in international trade. The main goal of my empirical exercise is to estimate the supply-side elasticity of prices with respect to quantities of goods purchased. Using the unique richness of my data, I estimate this elasticity within narrowly defined exporting firm – good cells.

In my baseline specification, the elasticity of prices with respect to quantities is approximately -0.2. That is, a 10% increase in quantity purchased reduces the price of a good produced by a particular exporter by 2%. The value of the estimated coefficient is robust across subsamples. These findings are consistent with second-degree price discrimination, a practice that allows firms to charge lower price when the volume of the purchase is higher. In a number of robustness checks, I rule out several competing explanations of the negative elasticity, such as non-classical measurement error and quality differentiation within narrowly defined exporter-goods categories.

In the second step, I rationalize these findings through the lens of a theoretical framework. Specifically, I develop a tractable general equilibrium model featuring two sectors with heterogeneous firms producing nontradable final and tradable intermediate goods. Departing from previous trade models, I assume that firms in the final good sector can only purchase inputs directly from their producers, reselling of inputs is not allowed. Intermediate good producers do not observe the type (productivity) of their buyers, but they know the distribution of those types across buyers. This leads firms that produce intermediate inputs to construct an optimal price-quantity schedule for their output, rather than to quote a single price. Intermediate good producers decide to have a quantity-payment schedule that is equivalent to a two-part tariff: a sum of a fixed payment and a part that is a product of quantity, a constant marginal cost, and a constant markup. As a result, the unit price is decreasing in quantity.

In the third step, I calibrate the model using the microdata and quantify the welfare effects of optimal policies. The model has four main parameters. Two of them are calibrated using the distribution of imports by Colombian firms and the distribution of exports by foreign firms. The other two parameters are taken from the literature on the trade elasticity and the elasticity of substitution in consumption. Using these parameter values, I perform three exercises. First, I quantify the welfare losses driven by second-degree price discrimination. For the baseline calibration these losses are equal to 5% in terms of real consumption. Second, I quantify the ratio of welfare under the optimal policies relative to welfare in the benchmark case with no taxes. I find that in a small open economy, optimal policy can increase welfare by around 2% in settings with monopolistic competition and second-degree price discrimination. Third, I quantify the costs of a ‘policy mistake’ — a case in which firms use second-degree price discrimination but a policymaker adopts taxes that are optimal under monopolistic competition. In a small open economy this mistake can lead to welfare losses of around 0.7%.