by ClausenCenter | Nov 25, 2024 | Grant, Research, Responsible Sourcing

by Alonso Alfaro-Ureña, Benjamin Faber, Cecile Gaubert, Isabela Manelici, Jose P. Vasquez||

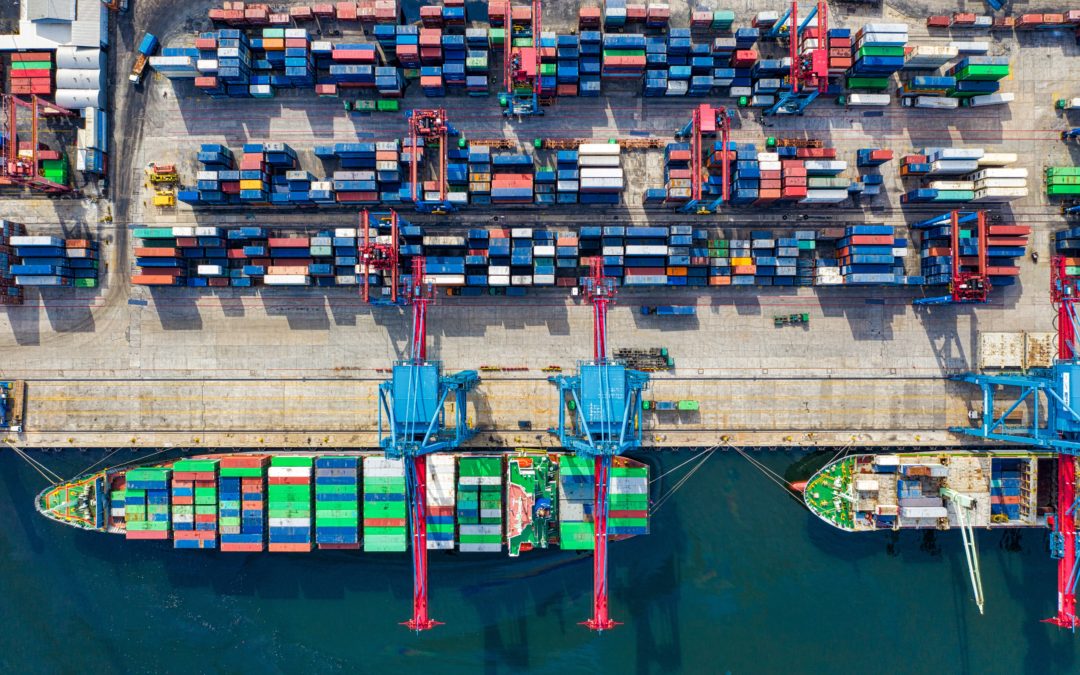

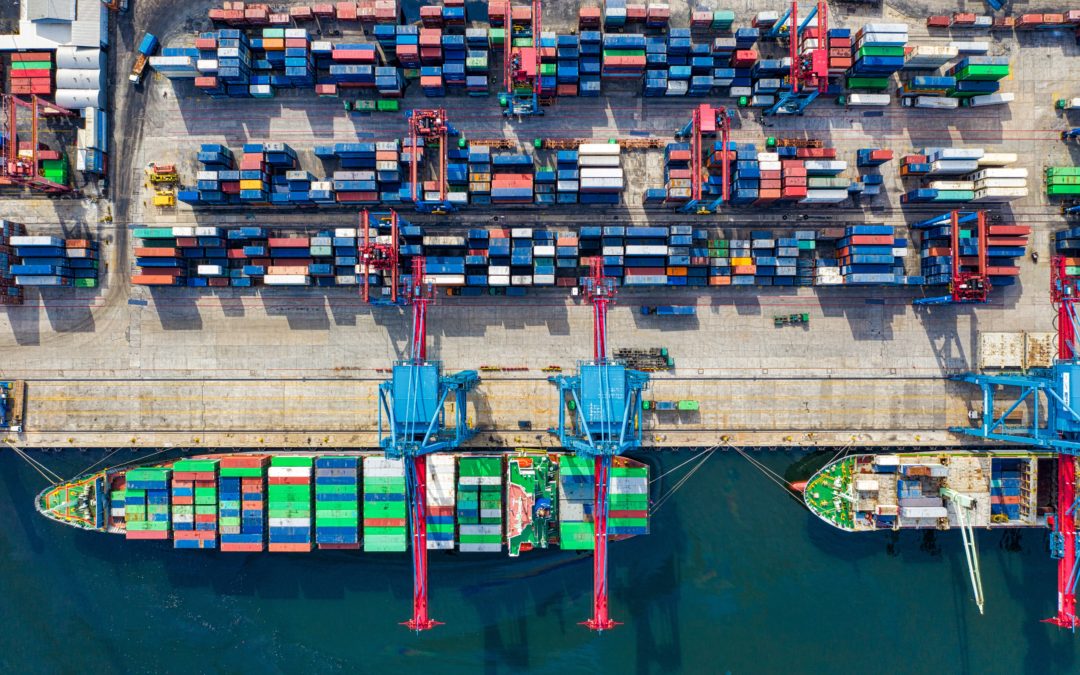

Multinational enterprises (MNEs) increasingly impose “Responsible Sourcing” (RS) standards on their suppliers worldwide, including requirements on worker compensation, benefits and working conditions. Are these policies just “hot air” or do they impact exposed suppliers and their workers? What is the welfare incidence of RS in sourcing countries? To answer these questions, the authors developed a quantitative general equilibrium (GE) model of RS and combine it with a unique new database. In the theory, they show that the welfare implications of RS are ambiguous, depending on an interplay between what is akin to an export tax (+) and a labor market distortion (−). Empirically,they combine the near-universe of RS rollouts by MNE subsidiaries in Costa Rica since 2009 with firm-to-firm transactions and matched employeremployee microdata. They find that RS rollouts lead to significant reductions in firm sales and employment at exposed suppliers, an increase in their salaries to initially low-wage workers and a reduction in their low-wage employment share. We then use the estimated effects and the microdata to calibrate the model and quantify GE counterfactuals. They find that while MNE RS policies have led to significant gains among the roughly one third of low-wage workers employed at exposed suppliers ex ante, the majority of low-wage workers lose due to adverse indirect effects on their wages and the domestic price index.

by ClausenCenter | Nov 25, 2024 | by Barry Eichengreen, Grant, International Financial Architecture, Research

by Barry Eichengreen, My T. Nguyen, Ganesh Viswanath-Natraj

Stablecoins’ reliance on centralized custodians introduces devaluation risk similar to that of traditional currencies under fixed exchange rate regimes. The authoers construct market-based measures of stablecoin devaluation risk using spot and futures prices for Tether, estimating an average devaluation probability of 60 basis points annually and peaking at over 200 basis points during the 2022 Terra-Luna crash. Key risk factors include market volatility and transaction velocity, with elevated interest rates indicating devaluation risk. Deviations from covered interest rate parity point to segmentation between traditional and stablecoin markets, driven by leverage trading and arbitrage costs. Our findings suggest the need for increased transparency and regulatory oversight to mitigate stablecoin risk.

by ClausenCenter | Sep 9, 2022 | News, Research

The winner of the 2022 WTO Essay Award for Young Economists is Mathilde Muñoz of the James M. and Cathleen D. Stone Center on Wealth and Income Inequality at the University of California, Berkeley. Her paper, “Trading Non-Tradables: The Implications of Europe’s Job Posting Policy”, was ranked first by the Selection Panel. She was presented with her prize of CHF 5,000 at the annual meeting of the European Trade Study Group in Groningen (the Netherlands) on 8 September 2022. Muñoz is an affiliated faculty member with the Clausen Center.

> Read the full story

by Katiana Resovich | Jan 3, 2020 | Financial Globalization, Research

From Professor Maurice Obstfeld’s Keynote speech at the Italian Economic Association Annual Meeting, Palermo, Italy, October 24, 2019:

“The bi-directional connections between nationalism and globalization – with globalization arguably spurring a nationalistic domestic politics and nationalism threatening policy shifts that compromise global economic integration – justify a focus on economic nationalism (de Bolle and Zettelmeyer 2019). In principle, economic policies aiming to further purely domestic objectives can be perfectly consistent with a high degree of global economic integration and cooperation. Thus, my key questions today will concern why this “divine coincidence” seems often difficult to achieve in practice, and why, when difficulties arise, global integration can be an early victim. While my goal is to get beyond quotidian observations about the “winners and losers from trade,” however essential these are as a starting point, you will see that my reflections add up to much less than a full and rigorous account. Still, it seems useful at least to put the current disruptions in their historical context – one objective being to illustrate the continuity with past developments and thereby offer hope that public action has some scope to address the current malaise.”

Read the full address on Professor Obstfeld’s website HERE.

by Katiana Resovich | Jan 3, 2020 | Financial Globalization, Research

Clausen Faculty Professor Maurice Obstfeld writes in his upcoming article in the Italian Journal of Economics, 2020:

“While the Global Financial Crisis of 2008-2009 was not a catastrophe on the order of World War I, there is a broad similarity in the sequelae to both of these events – a failed attempt to return to pre-trauma normalcy, followed by a process of international economic disintegration in the face of changed geopolitical realities. This similarity is history rhyming rather than repeating (in the phrase commonly attributed to Mark Twain), but it does raise three questions about possible cycles in globalization (also a theme of O’Rourke 2018):

- Does globalization inherently foster dynamics that eventually lead to political backlash?

- If so, are these dynamics inevitable, or can complementary economic policies nurture a stable globalization?

- And finally, since policies are endogenous, when are domestic policies that complement and support globalization likely to arise?

Obviously, these are very difficult questions to answer – all I will do here is offer some observations and guesses. Answers that are more complete would have to rely on rigorous and systematic analysis based on insights from a range of social sciences, not just economics.”

Access the full article on Prof. Obstfeld’s website HERE.

by ClausenCenter | Aug 12, 2019 | Conferences, Events, International Trade & Development

Sponsored by the Clausen Center for International Business and Policy at Berkeley and the Peterson Institute for International Economics University of California, Berkeley, February 13-14, 2020

Call for Papers

The last two decades of rapidly shifting comparative advantage have been associated with economic and social dislocations and trade policy tensions. Those factors played a central role in the election of Donald Trump to the U.S. presidency, who followed through on threats of aggressive trade actions against America’s trade partners. Because both major U.S. political parties now embrace trade skepticism, more belligerent international trade policies and the accompanying trade disputes are likely to remain a feature of the global scene even under future presidents.

Much of the trade-skeptic agenda comes from a desire to shift macroeconomic outcomes – whether labor-market outcomes, trade deficits, or overall economic growth. It is therefore critical for policymakers to have a firm grasp on the macro implications of trade policies. The academic literature on that subject has lagged behind modern modeling advances in other areas of economics, perhaps because those advances occurred in a period when a rules-based international trading system largely kept trade hostilities in check. Policymakers intervening to offset supposed effects of trade would also benefit from a better understanding of how the forces of globalization (as opposed to other economic trends) have shaped economic outcomes.

This conference aims to update the analytical framework for analyzing trade policies and trade shocks to encompass modern developments in macro modeling and in trade theory. The goal is to encourage people to write papers that are compatible with the basic requirements in both the trade and macro literatures and allow economists to provide quantitative answers to questions about the short- and long-run impacts of trade policies and shocks on the trade balance, employment, real wages, income distribution, growth, and welfare.

To that end, we welcome submissions across a range of topics that include but are not restricted to theoretical and empirical studies on:

- The effects of trade shocks on

- labor-market dynamics

- income distribution

- external imbalances and growth

- exchange rates

- direct investment flows and production location

- The rising importance and implications of global value chains.

- The appropriate macro policies to deal with trade shocks.

- The links between trade deficits and labor market outcomes.

- The role of bilateral imbalances and the economic costs of trade diversion in response to tariffs.

- The dynamics of trade warfare.

- The possible emergence of regional trading blocs.

- Macro impacts of quotas and other quantitative trade restrictions.

- Impact and longer-run effects of Brexit.

- Trade and investment effects of potential tax reforms.

- The linkages between global trade volume and global growth.

- The effects of trade policy uncertainty

Papers that integrate some aspect of trade in a macro framework will have priority. Proposals should be no more than 300 words in length and should give a clear account of the question(s) to be addressed and the analytical and/or empirical methodology, although they may be accompanied by draft papers.

Please send all proposals to:

The deadline for receipt of proposals is September 12, 2019.

Download a PDF of this call for papers.